TAX DEPRECIATION FACTS

What are Property Tax Allowances (Depreciation)?

Property tax allowances are a valuable aspect of any property investment due to their ability to enhance an investor’s return and produce a healthier cash flow, by correctly claiming and maximising the available deductions.

Property tax allowances form part of the Income Tax Assessment Act 1997 (ITAA 1997) and provide an opportunity for owners of income producing property to reduce their assessable income. There are a number of property tax allowances available to property owners, investors, and developers, including allowances for building structure and depreciation on plant. Property tax allowances are often simply referred to as tax depreciation.

What can I claim?

What allowances are available for my residential investment? Capital Allowances (Division 40 ITAA 1997). Capital allowances are available to owners of plant in both new and second-hand properties that produce assessable income. There is no legal definition of plant, however Income Tax Ruling 2000/18C10 lists over 1,200 assets that may be depreciable including carpets, air conditioning and light fittings.

Deductions for capital works (Division 43 ITAA 1997) Income producing buildings constructed after 17 July 1985 can be eligible for building allowances, of either 2.5% or 4% p.a. dependent upon construction commencement date. Building allowances are calculated using actual costs of construction or refurbishment, excluding the cost of all plant and non-eligible items e.g. land and soft landscaping.

Additional Claims Renovations, extensions, repairs, and write-off of demolished works can provide additional opportunities for the investor to increase the deductions and return on their property.

How do I submit a claim?

A high level of expertise is required to ensure that investors obtain maximum allowable entitlements. To submit a property tax allowances claim to the Australian Taxation Office (ATO), an investor should request a property tax allowances schedule from a professionally qualified person. Quantity Surveyors are stated as appropriately qualified people in Tax Ruling 97/25 and their schedule will substantiate an investor’s depreciation claim upon lodgement of their tax return with the ATO.

How is my claim analysed? Since all properties are different, a standard approach to depreciation cannot be applied. In order to maximise the deductions available for each specific property, and to substantiate the claim to the ATO, Melbourne Tax Depreciation (MTD) conducts a detailed examination of all available documents, together with a thorough on-site inspection of the property. The various calculations are then made to determine the appropriate deductions and allowances for the property.

When should I obtain a property tax schedule?

The best time is usually as soon as possible after settlement.

How much will this service cost? Fees are structured to reflect the building type, volume of reports required (multiple units within one complex may attract a discounted fee) and the depth of analysis required (All fees are tax deductible in the year of payment). Melbourne Tax Depreciation (MTB) would be pleased to provide an obligation free quote for your specific property investment.

Do I have to purchase a property tax allowances schedule each year?

Our property tax allowances schedule includes a summary of the investor’s tax claims for forty years. However, should any of the property’s specifications change through refurbishment, extension, or demolition during that time, an additional report should be generated to achieve the maximum allowable deductions.

What happens when I sell my property?

When a property is sold, there are potentially capital gains tax (CGT) and balancing adjustment issues which must be addressed. CGT may be payable on the land and buildings. Plant is exempt from CGT. However, when selling plant a balancing adjustment must be calculated. This ensures that total depreciation deductions correspond to the actual loss to the taxpayer.

PROPERTY DEPRECIATION CLAIMS ON OLDER PROPERTIES:

Investors often think that because their rental property is older that there is no worthwhile depreciation or allowances that can be claimed.

This is definitely not the case.

Division 43 allows deductions on capital works on residential properties from 18th July 1985. This generally refers to the ‘shell’ of the building and is usually referred to as ‘Building Write Off’ allowance. Older properties usually have amounts that can be claimed by virtue of any building work done to the property since that time. This could take into account common things like kitchen and bathroom renovations, extensions, reroofing, restumping and the like.

The amount claimable is 2.5% on a straight line basis over 40 years. This means that a property built in 1985 is still capable of being claimed up until 2025, and any improvements up to 40 years following the date of those improvements.

Other components of the building referred to generally as ‘plant & equipment are claimable as depreciable items under divisions 40 of the Income Tax Act.

These allowable deductions cover numerous items such as floor and window coverings, appliances, hot water units, mechanical fans, electric pumps, removable light shades, fluorescent lights, heating, cooling, security and fire alarms to name but a few.

For existing or previously used properties, where contracts were signed after 7:30 pm on May 9th 2017, then these division 40 (Div 40) items are no longer claimable. The pre-existing rules have been grandfathered for previously used properties where contracts where signed prior to this date.

For further information contact Melbourne Tax Depreciation (MTD) on 03 9873 7144 or email us at: erik@melbournetaxdepreciation.com.au

we will be happy to give you an obligation free quote or answer any questions about your particular property.

Ten things you should ask your Quantity Surveyor:

• Do you provide the proportional first year deduction?

• Do you calculate the decline in value from the date you first owned the property to that date available for lease?

• Do you inspect the property?

• Do you take into account any improvements that you have made whilst living in the property?

• Do you calculate the deductions for a full 40 years?

• Is your quantity surveyor registered with that tax practitioners board?

• Does your quantity surveyor only use appropriately qualified quantity surveyors to conduct inspections?

• Is your quantity surveyor registered with the Building practitioners board?

• Will your Quantity Surveyor update your schedule if you make improvements or replacements to your property?

• Does your Quantity Surveyor take account improvements carried out to your property at different times when preparing your Depreciation Schedule?

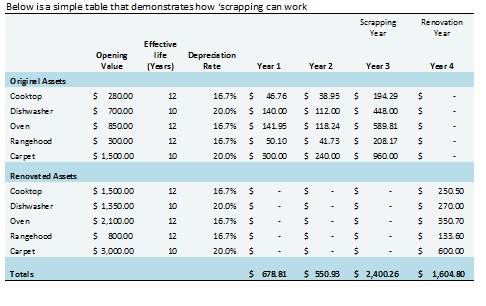

Renovation of existing buildings and disposing of eligible depreciable assets also known as ‘scrapping’:

Scrapping is the removal and disposal of any depreciable assets from an investment property.

It can be defined as the demolition or removal of any existing item of plant and equipment that was not yet fully depreciated.

Scrapping of existing, assetts such as cooking equipment, dishwashers, carpet and other easily removable items is an effective method of obtaining deductions within Australia’s tax system. It can provide additional tax deductions for property owners who demolish or dispose of existing plant and equipment assetts in their investment property.

If an investor decides on ‘Scrapping’ an item, the amount that is yet to be written off for a particular asset (the residual value) can generally be claimed as a 100% tax deduction at the time of disposal.

For further information contact Melbourne Tax Depreciation (MTD) on 03 9873 7144 or email us at: mtd@abbcon.com.au

we will be happy to give you an obligation free quote or answer any questions about your particular property.